Here Are The Cash Flows For Two Mutually Exclusive Projects 37+ Pages Solution in Doc [1.3mb] - Latest Update

You can check 35+ pages here are the cash flows for two mutually exclusive projects analysis in Google Sheet format. 0 115 115. At what interest rates would you prefer project a to b. Cash Flows dollars Project A - 115 Project B - 115 Year 45 64 65 64 85 64. Check also: cash and here are the cash flows for two mutually exclusive projects At what interest rates would you prefer project A to B.

Here Are The Cash Flows For Two Mutually Exclusive Projects. Here Are The Cash Flows For Two Mutually Exclusive Projects.

Question 4 As The Director Of Capital Budgeting For Chegg A -20000 8000 8000 8000.

| Topic: Here are the cash flows for two mutually exclusive projects. Question 4 As The Director Of Capital Budgeting For Chegg Here Are The Cash Flows For Two Mutually Exclusive Projects |

| Content: Answer |

| File Format: PDF |

| File size: 2.3mb |

| Number of Pages: 25+ pages |

| Publication Date: January 2019 |

| Open Question 4 As The Director Of Capital Budgeting For Chegg |

|

The companys required rate of return is 14 percent and it can get unlimited funds at that cost.

Cash Flows dollars Year Project A Project B. PROJECT z Co -20000 -20000 7600 0 W C 7600 0 7600 25000 a. Here are the cash flows for two mutually exclusive projects. Here are the cash-flow forecasts for two mutually exclusive projects. Round your answers to 2 decimal places. Cash Flows dollars Year Project A Project B 0 -119 -119 1 49 68 2 69 68 3 89 68 a-1.

Capital Budgeting For 9 220 Term 1 200203 19We can find the IRR of Project A and Project B is 9 and 8 respectively please see the calculation in excel in attachment So if the interest rate below 8 then Project A is more profitable than project B.

| Topic: Here are the cash flow forecasts for two mutually exclusive projects. Capital Budgeting For 9 220 Term 1 200203 Here Are The Cash Flows For Two Mutually Exclusive Projects |

| Content: Synopsis |

| File Format: DOC |

| File size: 2.8mb |

| Number of Pages: 9+ pages |

| Publication Date: December 2019 |

| Open Capital Budgeting For 9 220 Term 1 200203 |

|

Paring Mutually Exclusive Projects With Unequal Lives Here are the cash flows for two mutually exclusive projects.

| Topic: Enter your answer as a whole percent. Paring Mutually Exclusive Projects With Unequal Lives Here Are The Cash Flows For Two Mutually Exclusive Projects |

| Content: Learning Guide |

| File Format: Google Sheet |

| File size: 3mb |

| Number of Pages: 30+ pages |

| Publication Date: January 2019 |

| Open Paring Mutually Exclusive Projects With Unequal Lives |

|

Capital Budgeting Techniques Binam Ghimire 1 Objectives Expected Cash flows for Two mutually exclusive investments.

| Topic: Do not round intermediate calculations. Capital Budgeting Techniques Binam Ghimire 1 Objectives Here Are The Cash Flows For Two Mutually Exclusive Projects |

| Content: Answer Sheet |

| File Format: PDF |

| File size: 1.9mb |

| Number of Pages: 13+ pages |

| Publication Date: March 2018 |

| Open Capital Budgeting Techniques Binam Ghimire 1 Objectives |

|

Abc Ltd Plans To Invest In Two Mutually Exclusive Chegg Do Not Round Intermediate Calculations.

| Topic: Download the Android app Chapter 8 HW Here are the cash flows for a project under consideration. Abc Ltd Plans To Invest In Two Mutually Exclusive Chegg Here Are The Cash Flows For Two Mutually Exclusive Projects |

| Content: Analysis |

| File Format: PDF |

| File size: 6mb |

| Number of Pages: 6+ pages |

| Publication Date: December 2017 |

| Open Abc Ltd Plans To Invest In Two Mutually Exclusive Chegg |

|

Mutually Exclusive Projects How To Evaluate These Projects Examples The after-tax cash flows for two mutually exclusive projects have been estimated and the following information has been provided.

| Topic: Round your answers to the nearest whole dollar b. Mutually Exclusive Projects How To Evaluate These Projects Examples Here Are The Cash Flows For Two Mutually Exclusive Projects |

| Content: Analysis |

| File Format: DOC |

| File size: 2.1mb |

| Number of Pages: 22+ pages |

| Publication Date: April 2017 |

| Open Mutually Exclusive Projects How To Evaluate These Projects Examples |

|

As The Capital Budgeting Director For Denver Chegg Project C 0 C 1 C 2 C 3.

| Topic: Here are the cash flows for two mutually exclusive projects. As The Capital Budgeting Director For Denver Chegg Here Are The Cash Flows For Two Mutually Exclusive Projects |

| Content: Synopsis |

| File Format: PDF |

| File size: 2.3mb |

| Number of Pages: 24+ pages |

| Publication Date: November 2019 |

| Open As The Capital Budgeting Director For Denver Chegg |

|

Doc Homework4 With Ans J Madina Nurzhigitova Academia Edu Do not round intermediate calculations.

| Topic: Cash Flows dollars Year Project A Project B 0 -119 -119 1 49 68 2 69 68 3 89 68 a-1. Doc Homework4 With Ans J Madina Nurzhigitova Academia Edu Here Are The Cash Flows For Two Mutually Exclusive Projects |

| Content: Summary |

| File Format: PDF |

| File size: 2.6mb |

| Number of Pages: 4+ pages |

| Publication Date: April 2017 |

| Open Doc Homework4 With Ans J Madina Nurzhigitova Academia Edu |

|

4 Two Mutually Exclusive Projects Have Projected Cash Flows As Follows End Of Year 0 Project A 2 000 1 000 1 000 1 000 1 000 Project B 2 000 0 0 6 000 A Determine The Internal Rate Of Return F Homeworklib PROJECT z Co -20000 -20000 7600 0 W C 7600 0 7600 25000 a.

| Topic: Cash Flows dollars Year Project A Project B. 4 Two Mutually Exclusive Projects Have Projected Cash Flows As Follows End Of Year 0 Project A 2 000 1 000 1 000 1 000 1 000 Project B 2 000 0 0 6 000 A Determine The Internal Rate Of Return F Homeworklib Here Are The Cash Flows For Two Mutually Exclusive Projects |

| Content: Answer Sheet |

| File Format: DOC |

| File size: 3mb |

| Number of Pages: 10+ pages |

| Publication Date: March 2019 |

| Open 4 Two Mutually Exclusive Projects Have Projected Cash Flows As Follows End Of Year 0 Project A 2 000 1 000 1 000 1 000 1 000 Project B 2 000 0 0 6 000 A Determine The Internal Rate Of Return F Homeworklib |

|

Psb Tutorial Solutions Week 2 Internal Rate Of Return Present Value

| Topic: Psb Tutorial Solutions Week 2 Internal Rate Of Return Present Value Here Are The Cash Flows For Two Mutually Exclusive Projects |

| Content: Synopsis |

| File Format: DOC |

| File size: 1.7mb |

| Number of Pages: 21+ pages |

| Publication Date: June 2020 |

| Open Psb Tutorial Solutions Week 2 Internal Rate Of Return Present Value |

|

Answered 28 A Pany Is Considering Two Bartle

| Topic: Answered 28 A Pany Is Considering Two Bartle Here Are The Cash Flows For Two Mutually Exclusive Projects |

| Content: Learning Guide |

| File Format: Google Sheet |

| File size: 2.8mb |

| Number of Pages: 6+ pages |

| Publication Date: December 2018 |

| Open Answered 28 A Pany Is Considering Two Bartle |

|

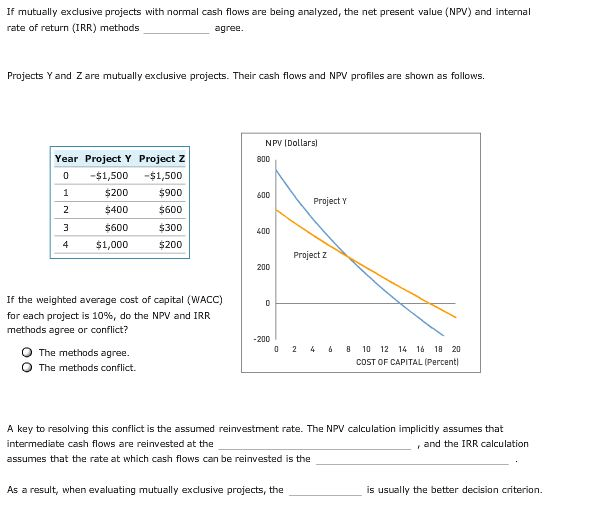

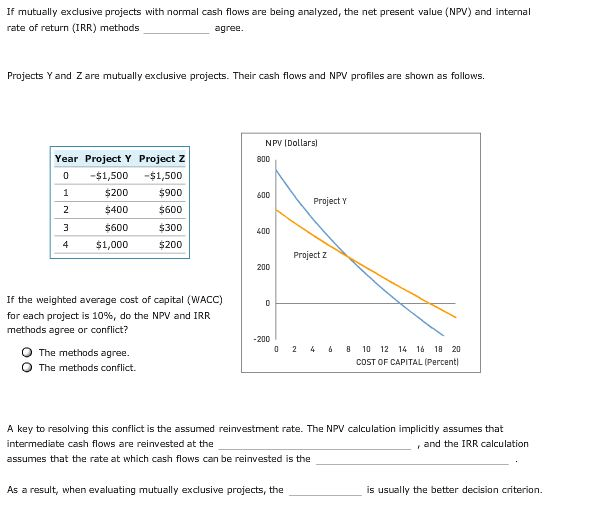

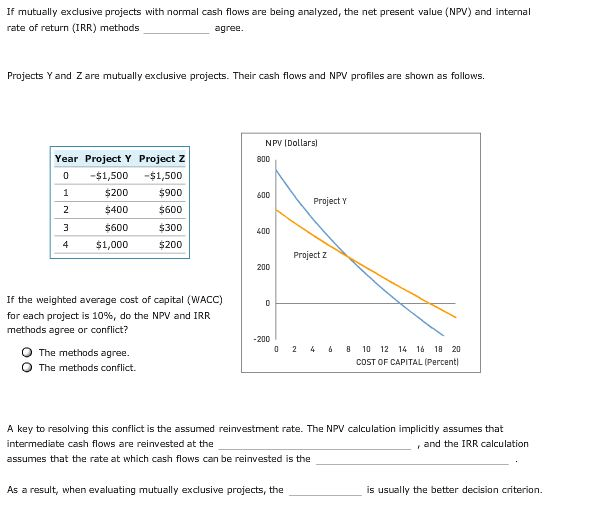

Solved If Mutually Exclusive Projects With Normal Cash Flows Are Being 1 Answer Transtutors

| Topic: Solved If Mutually Exclusive Projects With Normal Cash Flows Are Being 1 Answer Transtutors Here Are The Cash Flows For Two Mutually Exclusive Projects |

| Content: Summary |

| File Format: DOC |

| File size: 1.6mb |

| Number of Pages: 23+ pages |

| Publication Date: April 2021 |

| Open Solved If Mutually Exclusive Projects With Normal Cash Flows Are Being 1 Answer Transtutors |

|

Its really simple to get ready for here are the cash flows for two mutually exclusive projects As the capital budgeting director for denver chegg project cash flow n a b example 1 consider the following two mutually exclusive investment projects assume ppt video online download capital budgeting for 9 220 term 1 200203 capital budgeting techniques binam ghimire 1 objectives paring mutually exclusive projects with unequal lives psb tutorial solutions week 2 internal rate of return present value answered 28 a pany is considering two bartle question 4 as the director of capital budgeting for chegg

Post a Comment

Post a Comment